Raghav's Blog

Personal Events

10 Jul 2014

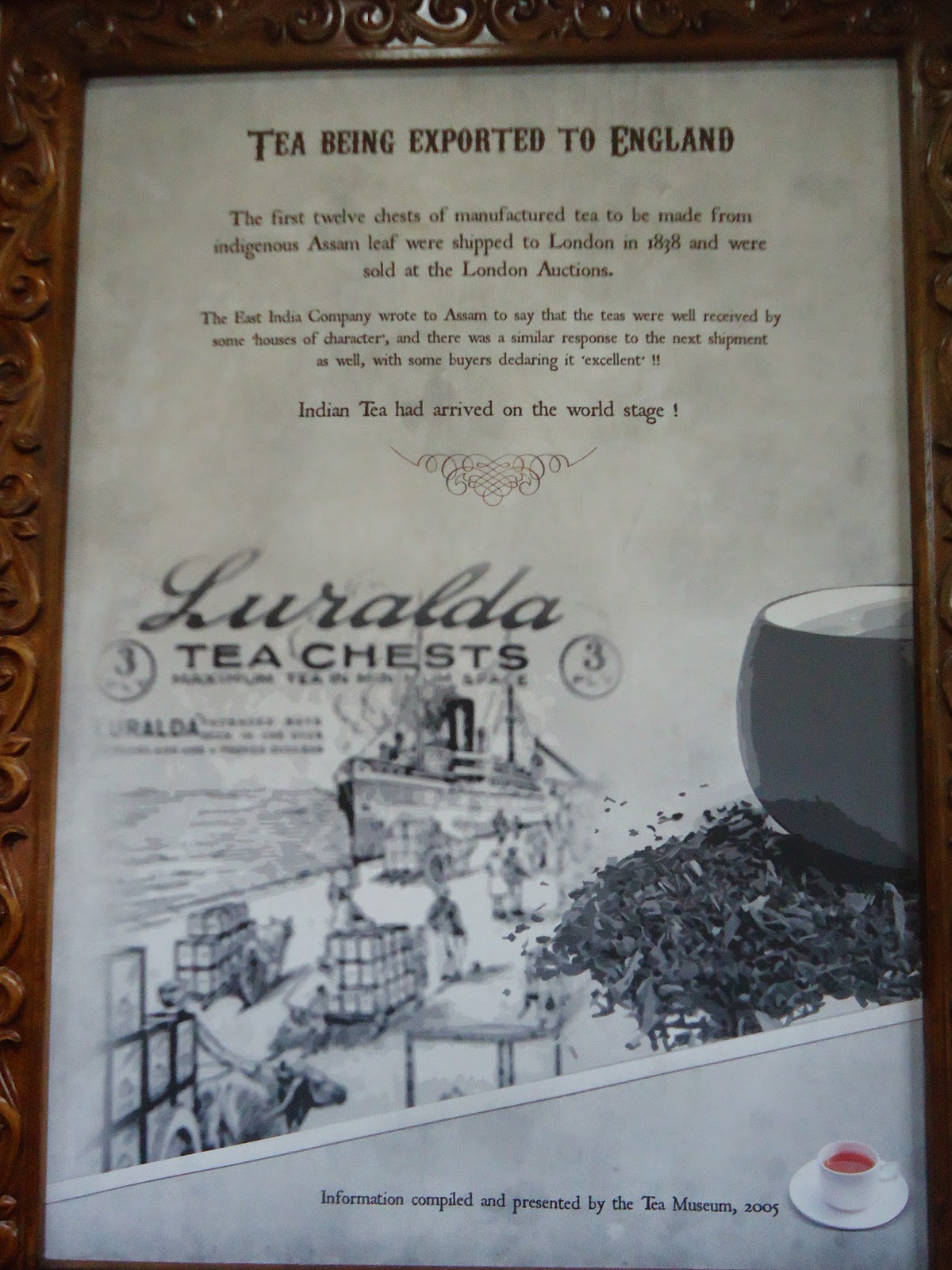

The Tea Factory - Ooty

Location: Chennai, India

Ooty, Tamil Nadu, India

7 Feb 2014

Sivagangai Trip

Location: Chennai, India

Sivaganga, Tamil Nadu, India

9 Jan 2013

Debate on FDI in Retail

Today, Meenakshi Sundararajan School of Management conducted a debate on

"Foreign Direct Investment in retail" commencing the debate with a

prayer and a floral tribute to the founder of the institution. Followed by

Dr.H.Sankaran, Principal and Shri V.S.Vikram Director gave a wonderful welcome

address and felicitations to students, chief guest and speakers.

The Introduction of chief guest & speakers were given by Prof.

Saiju.M.John HOD.

Chief Guest of the Debate:

Participants of the Debate:

Against

FDI:

- Mr.L.Annamalai (MICA), Founder/Ideator of OHO Productions, Chennai

- Mr.S.Sambamoorthy, Founder of Howzatt & Founder/Ideator of OHO Productions, Chennai

For

FDI:

- Mr. Manu Srinivas (MICA), Founder of Kappi Cheenu, Chennai

- Mr. Manoj Ramanan (IIM-C)

The purpose of the Debate was to make the students understand

- The aspects of FDI

- FDI from a Socio-economic

perspective

- FDI in retail's postitive

and negative impact on the economy

Against FDI:

Mr.L.Annamalai & Mr.S.Sambamoorthy spoke about

Globalization and Foreign Influx, Market Imperialism, Business point of view of Kirana shops in India, Indian entrepreneurs (Annachies), Middle men problem in retail industry, Governments Intervention to have price and margin control, Indians attraction towards western culture, State government’s acceptance towards FDI, Kirana shop's hospitality, flexibility, personal relationship with the

customers, Convenience seekers in India,

Margin fixation by retailers, Sustainability of FDI in longer run, Negative impact of FDI on Indian products, Short and long term vision of Indian government, Profits taken out of India by Foreign players and SEZ's contract with government.

For FDI:

Mr. Manoj Ramanan & Mr. Manu Srinivas spoke about

Indian market players, Quality of food related products in Kirana shops, Price hike on Food related products, Liberalization, Quality of superior products, Foreign retailer's world class processes, 30% local rule on foreign retailers, FDI's pull towards the world class standards, US(60 - 70%) and Indian (20%) farmers margin on MRP, Wastages on perishable goods because of lack of cool storage for

the farmers, Benefits of the Indian farmers, Increase in competition, Globalization of Indian brands, Shift from Emotional aspects to rational aspects, Benefits of Foreign retailer’s competition and Manufacturing companies collaboration with foreign companies.

Finally,

the adjudicator Prof.S.Badrinathan concluded the debate and gave invaluable advice to the management students by sharing his professional experience.

Location: Chennai, India

Chennai, Tamil Nadu, India

9 Oct 2012

Short term investment strategy for Stock Mind game

It seems that everyone who are about to participate in “Stock

Mind” game have some sort of questions in their mind, but at my point of view I

found a similar question among every one which is how to go about it? If you too have the same question prevailing in

your mind then continue reading. This blog post will give you some suggestion

as how to plan and execute an effective short term investment strategy for our

ten day stock mind game.

Which approach am I supposed to use? - Fun or Tek

Which approach am I supposed to use? - Fun or Tek

Firstly, let’s decide which analysis better suits the game.

I know that everyone have read well and more about fundamental and technical

analysis which helps one to analyze a security and make investment decision

from our academics. I think its time to apply those methods in this game to

make some winning decisions. Fundamental analysis involves analysing the

characteristics of a company to estimate its intrinsic value whereas technical

analysis is all about studies of supply and demand in the market to determine

what direction/trend will continue in the future. Contrary to the fundamental

analysis, technical analysis doesn’t even care about the value of the company. Both

are very broad topics so you’ll need to dig deeper into the concepts to

understand it. Lets get into the details of how these two approaches differ

to find which suits us.

Firstly, let’s decide which analysis better suits the game.

I know that everyone have read well and more about fundamental and technical

analysis which helps one to analyze a security and make investment decision

from our academics. I think its time to apply those methods in this game to

make some winning decisions. Fundamental analysis involves analysing the

characteristics of a company to estimate its intrinsic value whereas technical

analysis is all about studies of supply and demand in the market to determine

what direction/trend will continue in the future. Contrary to the fundamental

analysis, technical analysis doesn’t even care about the value of the company. Both

are very broad topics so you’ll need to dig deeper into the concepts to

understand it. Lets get into the details of how these two approaches differ

to find which suits us.

In Fundamental analysis it tries to determine the intrinsic

value of company by looking at its balance sheets, cash flow statements and

income statements. Its fairly very easy to take decisions in this approach. If you

ascertain and invest in a company’s stock which trades below its intrinsic

value then it a good investment. However, it takes a long time for a company’s

intrinsic value to get reflected in the market so till then no gain will be

realised. They call this as value investing and assume that the short-term market

is wrong and believe it’ll correct itself in long run.

Some critics say that Technical analysis as a form of black

magic. Don’t get surprised but recently it has got some credibility like

fundamental analysis. Technical analysis argues that the past trading

information is already reflected in the price of the stock and, it is useless

to value an undervalued stock/security. Here in technical analysis it tries to

determine the trend instead of the intrinsic value by looking at the historical

charts, indicators and oscillators. It believes that prices of a stock moves in

trend and history tend to repeat itself. For a short term investment decision

this analysis suits best.

Some critics say that Technical analysis as a form of black

magic. Don’t get surprised but recently it has got some credibility like

fundamental analysis. Technical analysis argues that the past trading

information is already reflected in the price of the stock and, it is useless

to value an undervalued stock/security. Here in technical analysis it tries to

determine the trend instead of the intrinsic value by looking at the historical

charts, indicators and oscillators. It believes that prices of a stock moves in

trend and history tend to repeat itself. For a short term investment decision

this analysis suits best. I would suggest everyone to concentrate more on Technical analysis rather than Fundamental analysis to grow your portfolio's value within ten days. Tomorrow I’ll give more information about the strategies while investing and how am I going to use technical analysis to take investment decisions. Guys if you are so curious go back and take out your Security analysis and portfolio management books to have a glance on technical analysis. See you guys tomorrow.

2 Oct 2012

An industrial visit to Indian Piston Rings

- We visited India Piston Rings Ltd on 1st October 2012 at 12:00 P.M to 4:00 P.M at Maraimalai nagar plant, Chennai.

- Prof.Ranganathan, Ms.Renuka & Ms.Jaisuchi tailor led students on the visit.

- On behalf of Company Mr.Rajamanikam (HRD General Manager) welcomed and also gave invaluable information regarding India Piston Ring Ltd. He also accompanied and explained us the various process in the plant.

Company

Fact Sheet

Company Information : India Piston Rings is promoted by India Piston limited a memeber of the amulgamation group. It is one of the largest producers of Pistons, Piston rings, Gudgeon rings, Cylinder liners and allied components in India. Formed by Mr.S.Anantharamakrishnan in July 1949. In 2010-11 its revenue was $350 million.

Year of

Establishment : 1991

Nature

of Business : Manufacturer

Total

Number of Employees : 600 Employees

Conform

Employees (Operators) : 150

Trainee/Apprentice : 150

Management Staff : 110

Contract Employees : 125

Supervisors/B.E : 80

(75%

of employees are ITI holders & 25% are +2 & 10)

Major Markets : Indian –

OEM (Original Equipment Manufacturers)

Primary Competitive Advantage

: Technical

collaboration with Nippon Piston Rings, Japan

: Surface

Coating Technology

: Latest

Surface Coating Technology

: Experienced

R&D department

: Good

TQM implementation

Plant and Machinery:

At India piston rings, they have latest state of the art manufacturing

plants and machineries having a capacity of 10 lakh piston rings per month. India

piston ring produces piston rings, both compression and oil control rings for a

variety of gasoline and diesel engines. They offer Pistons made out of a

variety of high quality cast iron and steel materials. Their raw materials are

being imported from Japan and the materials ranges from grey cast iron; (heat treated)

alloyed grey cast iron to sperodial graphite cast iron. Their product Piston

rings which includes high alloyed steel having 17% carbon content. In India

piston rings they have process which include surface treatments or coatings

like Granoliting, Chrome plating, Chrome Molly, Molybdenum, Moly Chrome Ceramic

and Flame sprayed coatings. Their Piston rings fits for Pistons with bore

diameters ranging from 35 to 160mm.

Products of the Company:

- Piston Rings for four wheeler & Gears

Quality Assurance:

They are quality oriented organisation which is ISO 9001:2008

for management system and ISO/TS 16949 an ISO for technical specification aiming

to the development of a quality management system that provides for continual

improvement, emphasizing defect prevention and the reduction of variation and

waste in the supply chain. The company believes in providing the clients with

the premium quality products as per their specifications and requirements. In my

observation I found that their quality control is rigid and they implement TQM

(Total Quality Management) system so that the finished products are at par with

the international quality standards.

Manufacturing Units:

They have the manufacturing process in the latest technology

from Japan is installed. This ensures the quality and fast production of Piston

rings. Manufacturing is done as per the specifications and the requirements of

their clients. Major of their selling is to the OEM (Original Equipment

Manufacturer) in India and they do export a very little amount of their

products to Bangladesh, Nepal and Sri Lanka. They have divided their

manufacturing units into 24 zones for better maintenance.

Ware-housing and packaging:

They have a well spacious warehousing unit for the safe

storage of products. Quality is assured at every stage.

Current and Future Expansions:

In our conversation with Mr. Rajamanikam, he briefed us about

the future plans. In 2004 they expanded themselves into gear manufacturing from

Piston Rings. Also, by very next year they are planning to enter into the 2

Wheeler piston ring market. The entire organisation strive to achieve 5 star

because an external audit which is conducted every year by Hyundai rate in 5

star. If they achieve they bag the project to supply piston rings to Hyundai

all over the world.

Clients:

They have a huge customer base in India.

1.

Ashok

Leyland

2.

Tata

3.

Mahindra

4.

Eicher

5.

Escorts

6.

Hindustan

Motors

7.

Ford

8.

Maruti

Suzuki

9.

Royal

Enfield

1. Hyundai

Competitors:

In our conversation with Mr.Rajamanikam, India Piston Rings

currently have a 50% market share and their major competitor is Sriram pistons

& rings ltd.

Some Good Practices found in India Piston Rings:

- Hands on system – Each machine has a Beacon attached. Where three lighting are there which has specific meaning.

o

Green

Light – Machine is functioning

o

Red

Light - Some Problem in the Machine

o

Amber

- Machine is in need of materials

- OPC (Operation Control Process) – To recycle the scraps. Currently, they sell their paper scraps and 1.2% industrial scraps to the vendors.

- 2 suggestions for improvement in process is mandatory for each employee per month.

- Small Group activities scheme is introduced and managed.

Achievements:

- 100PPM certificate from Hyundai

- Gold and Platinum award for quality excellence

- Frust and Sullivan IMEA super gold award for manufacturing

- ACMA silver trophy for excellence

- HV Axles ltd – best new mod. Company

Corporate Social Responsibility:

- Rain water harvesting – Maintained in their own premises

- Commitment to Society – Park maintenance at Maraimalai nagar

- Recently donated 3 lakh worth X-ray unit to hospital

- Annually they spend 4 lakh for Single teacher program – 10 schools are being maintained by the management and 4 schools by the employees contribution.

Subscribe to:

Comments (Atom)